Upcoming Events

Stay in the know about what’s going on with our calendar of events. Join us and share our Millionaire pride!

VIEW CALENDARJuly

WASD's Summer String Camp returns July 28-July 31. Camp will run daily from 9 a.m. to 12:15. The camp will end with capstone performance starting at noon on Thursday, July 31.

Start: 9:00 AM

July

Marching Millionaires July Camp will run from 1-9 p.m. from July 28-Aug. 1.

Start: 1:00 PM

August

WASD's Youth Band Camp returns Aug. 4-Aug. 7. Camp will run daily from 9 a.m. to 12:15. The camp will end with capstone performance starting at noon on Thursday, Aug. 7.

Start: 9:00 AM

August

Marching Millionaires August Camp will run from 1-9 p.m. from Aug.11-Aug. 14.

Start: 1:00 PM

August

The School Board meets the second Tuesday of each month. Click "Learn More" to see additional upcoming meeting dates.

Start: 6:00 PM

August

Welcome new teachers! New teacher induction will take place from 8 a.m. to 3:30 p.m. on Monday, Aug. 18, and Tuesday, Aug. 19.

Start: 8:00 AM

August

WAMS' Open House is scheduled from 6 to 7:30 p.m. for seventh-grade students and 6:30 to 7:30 p.m. on the same night for eighth-grade students.

Start: 6:00 PM

August

No school for students. Click on "Learn More" to see a full schedule of K-12 Professional Development Days for the 2025-2026 school year.

ALL DAY August

Curtin Intermediate School will hold its open house from 5:30 to 7 p.m.

Start: 5:30 PM

August

Lycoming Valley Intermediate School's open house will be from 5:30-7 p.m., with fourth-grade open house from 5:30-6:15 p.m. and fifth-/sixth-grade open house from 6:15-7 p.m.

Start: 5:30 PM

August

Open House for Cochran, Hepburn-Lycoming and Jackson Primary schools will be held from 5:30-7 p.m.

Start: 5:30 PM

August

Open House for Cochran, Hepburn-Lycoming and Jackson Primary schools will be held from 5:30-7 p.m.

Start: 5:30 PM

August

Open House for Cochran, Hepburn-Lycoming and Jackson Primary schools will be held from 5:30-7 p.m.

Start: 5:30 PM

August

WAHS will host its Open House for freshmen and new students starting at 7 p.m. 11th- and 12th-grade students' "What's My Plan After Graduation" presentation begins at 7:30 p.m. All other high school students' open house is from 7-8:30 p.m.

Start: 7:00 PM

August

No school for students.

ALL DAY August

We're back! Students in grades 1 through 9 return to school. Parents of kindergarten students should refer to information sent home regarding your child's start date.

ALL DAY August

The first day of school for 10th- through 12th-grade students is Tuesday, Aug. 26.

ALL DAY September

All schools and district offices closed.

ALL DAY October

No school for students.

ALL DAY Recent News

Stories and achievements about our students and staff doing amazing things in the classroom and community.

VIEW ALL NEWS Image for 2025-2026 WASD Open House Schedule Announced

WASD has announced the dates for its annual round of open houses to kick off the start of the 2024-2025 school year.

Image for WASD Bids Farewell to 28 Retirees in Video Tribute

As the WASD eyes the end of another school term, it pledged its farewell to 28 retirees. In a video tribute, administrators and supervisors said goodbye to this year's class of retirees, who, together, represent a combined 550+ years of experience.

Image for WAHS 4th Marking Period Honor Roll Listing Released

WAHS released the year's fourth marking period honor roll listing. Three-hundred and one students in grades nine through 12 are named as having earned their status on the distinguished honor roll, high honor roll or honor roll roster.

Image for WASD Secures 'Best Communities for Music Education' Designation for 23rd Year

WASD has once again been recognized as one of the Best Communities for Music Education from The NAMM Foundation for its outstanding commitment to music education. This is the 23rd year that WASD has received the designation — making the district the longest-running recipient in the state.

Image for Nominations Sought for WAHS 2025 Distinguished Alumni Awards

The WASD Education Foundation is seeking nominations for the district’s 2025 Distinguished Alumni Awards. The 2025 recipients will be celebrated and recognized during education foundation’s third annual Cherry + White Appreciation Night on Thursday, Sept. 25.

Image for 298 Receive Diplomas During 154th Commencement Ceremony

Last evening, 298 graduates proudly celebrated their achievements and received their diplomas during WAHS's 154th commencement ceremony.

Image for Soaring Toward the Future: WAHS Senior Earns Private Pilot's License

At just 18 years old, WAHS senior Trevor Estes is already flying high — literally. A standout student in not one but two Career and Technical Education (CTE) programs, Estes recently earned his private pilot’s license

Image for 5 Students Celebrated for their Commitment to Military Service

WAHS recognized five seniors for their commitment to military service Monday afternoon. Millionaire servicemen and -women were celebrated during a ceremony held in front of the Millionaire Military Wall.

Image for 32 School-to-Work Students Recognized During Annual Appreciation Breakfast

Thirty-two students involved in WAHS's School-to-Work Program were honored during its annual Community Partners Appreciation Breakfast this morning at the high school.

Image for WAHS Senior Jayden Ulmer Commits to Penn State-Altoona

Joined by friends family, principals and coaches, WAHS senior Jayden Ulmer signed her letter of intent today to continue athletic and academic career on the volleyball team at Penn State-Altoona this fall.

Image for WAHS Music Department Holds Annual 'Poptastik!' Concert

The WAHS music department brought a year in music to a close last night with its annual "Poptastik!" concert! The school's band, choral and orchestra members performed chart-topping pop and rock hits from over the decades.

Image for WAHS Recognizes 2025 CTE Students of the Year

The WAHS Career and Technical Education (CTE) Program hosted its second Student of the Year luncheon, during which the department's faculty selected their standout students to celebrate.

Image for WASD Education Foundation Presents $5,921 to WAMS OM Team Headed to the World Finals

The WASD Education Foundation presented $5,921 to Williamsport Area Middle School’s Odyssey of the Mind team, which heads to the World Finals at Michigan State University this week.

Image for 8 WAHS Student-Athletes Commit to Compete at Collegiate Level

Joined by friends family, principals and coaches, eight WAHS student-athletes signed their letters of intent Monday afternoon to continue their athletic and academic careers at the collegiate level this fall.

Image for Top Hat Dinner Honors WAHS Class of 2025's Top 5 Percent

The WAHS Class of 2025’s top 5 percent were recognized on Wednesday, May 14, during the 12th annual Top Hat Dinner held on the campus of Pennsylvania College of Technology.

Image for 123 Students Celebrated, 72 Inducted at WAHS National Honor Society Ceremony

One hundred and twenty-three WAHS students were celebrated on Wednesday night during the National Honor Society Ceremony, and, from among them, 72 were inducted as new members from the junior and senior classes.

Image for 64 Students Celebrated, 41 Inducted at WAMS National Junior Honor Society Ceremony

Sixty-four WAMS students were celebrated Sunday during the National Junior Honor Society Ceremony, and, from among them, 41 were inducted as new members from grades seven and eight.

Image for Ribbon-Cutting Ceremony, Open House Set for Renovated Lycoming Valley Intermediate School

WASD will host a public ribbon-cutting ceremony and open house celebrating the recent completion of major renovations at Lycoming Valley Intermediate School, scheduled from 5-7 p.m. on Monday, May 5

Image for 8 WAHS Students Place at State SkillsUSA Competition

Eight WAHS students who earned first-place finishes at the regional SkillsUSA competition in February advanced to the state event, held recently in Hershey, Pa.

Image for WAHS Students Excel at Regional Model UN Convention

Forty-eight students from WAHS showcased their diplomatic skills on Friday at the regional Model United Nations convention held at Penn College, competing against more than 150 students from 11 area schools.

Image for 3 Musicians Depart for 2025 PMEA All-State Festival

Three WAHS student musicians are set to depart for one of the most prestigious music events in the state: the 2025 Pennsylvania Music Educators Association (PMEA) All-State Festival.

Image for The GIANT Co. Donates $6,622 to WASD Food Service Program

The Giant Co. presented WASD with $6,621.76 Tuesday morning to benefit the district’s food service program. The donated funds will be used to support kitchen improvements at Jackson Primary School.

Image for WAHS 3rd Marking Period Honor Roll Listing Released

WAHS released the year's third marking period honor roll listing. Three-hundred and thirty-one students in grades nine through 12 are named as having earned their status on the distinguished honor roll, high honor roll or honor roll roster.

Image for WAMS OM Team Advances to 2025 World Finals on 1st-Place Win at State Tournament

WAMS's Odyssey of the Mind team will head to the 2025 World Finals after securing a first-place win at the state round on Saturday at Pocono Mountain East Campus.

Image for WAHS Students Shine in Spring Musical, 'Seussical'

The WAHS music department hosted its annual musical on Friday and Saturday with its spring production of "Seussical."

Image for Temporary Road Closure at WAHS for Mock Crash Filming on April 6

Please be advised that a section of WAHS's Millionaire Lane will be temporarily closed beginning at 3 p.m. on Sunday, April 6. The closure will extend from the Fox Hollow Road entrance at the north end of campus to the bus loop at the top of the hill.

Image for WAHS Art Department to be Featured at 2025 Master & Grasshopper Exhibition

The WAHS art department will be represented at the 2025 Master & Grasshopper Exhibition at the Loomis Gallery at Commonwealth University’s Mansfield campus.

Image for 'Seussical' Coming to the WAHS Stage April 4-5

The WAHS music department is preparing for its annual musical production. “Seussical” is set to hit the stage beginning at 7 p.m., Friday, April 4, with a matinee performance scheduled for 1 p.m., Saturday, April 5.

Image for WASD Education Foundation Awards $36,665 in Grant Funding to District Programs, Projects

The WASD Education Foundation recently approved $36,665 in grant funding to support various district programs and projects in its latest grant rounds for the 2024-2025 school year.

Image for WAHS SADD Club Wins 1st Place in Statewide Suicide Prevention Video Contest for 4th Consecutive Year

WAHS SADD Club Wins 1st Place in Statewide Suicide Prevention Video Contest for 4th Consecutive Year

A WAHS video produced to help raise awareness on mental health stigmas and suicide prevention received first place for the fourth consecutive year in a recent statewide PSA contest conducted by Prevent Suicide PA.

Image for WASD Statement

WASD acknowledges the court’s decision to acquit former WAHS principal Dr. Roger Freed of all charges. We recognize that this situation has been a long, difficult and emotional process to endure and has deeply affected many members of our school community.

March 7, 2025

Image for WASD Education Foundation to Participate in 2025 'Raise the Region'

The WASD Education Foundation will once again participate in Raise the Region, the 30-hour online fundraising event hosted by the First Community Foundation Partnership of PA. It begins at 6 p.m. Wednesday, March 12, and ends at 11:59 p.m. on Thursday, March 13.

Image for 5 WASD Odyssey of the Mind Teams Advance to State Finals

Five of the seven WASD Odyssey of the Mind teams that competed in the Regional Tournament on March 1 in Berwick are headed to the State Finals. This year’s contending teams from WASD were represented by Cochran Primary, Curtin Intermediate, WAMS and WAHS.

Image for 'Matilda Jr.' Coming to the WAMS Stage

“Matilda Jr.” is set to hit the WAMS stage beginning at 7 p.m. on Friday, March 7, with a matinee performance scheduled for 2 p.m. on Saturday, March 8.

February 28, 2025

Image for WAHS Orchestra Teacher to Receive 2025 PMEA Citation of Excellence Award

WAHS orchestra teacher Matthew Radspinner will be recognized for his lasting contributions to the field of music education. He has been selected to receive the 2025 Pennsylvania Music Educators Association (PMEA) Citation of Excellence in Teaching Award for District 8.

Image for WAHS's Parker Johnson Selected to Play in 2025 Big 33 Football Classic

WAHS senior Parker Johnson has been selected to play as a kicker in the Big 33 Football Classic, one of the nation’s premier scholastic All-Star games.

Image for 26 WAHS Students Earn Top 3 Placements in Regional SkillsUSA Competition

Forty-three WAHS students recently competed in the regional SkillsUSA competition at Pennsylvania College of Technology, and, of them, 26 earned top three placements and eight move on to compete in the state round.

Image for WAHS 2025 Summer School Enrollment Opens

Registration is open to enroll in summer courses at WAHS. Acceleration courses are available to all high school and incoming freshmen, which will be taken online. Registration deadline is May 22 and classes begin June 9.

February 14, 2025

Image for WASD Celebrates Board Recognition Ceremony

WAD hosted a special board recognition event Tuesday night to honor the dedication and contributions of school board members. As part of the celebration, students from each of the district's schools recognized board members.

February 12, 2025

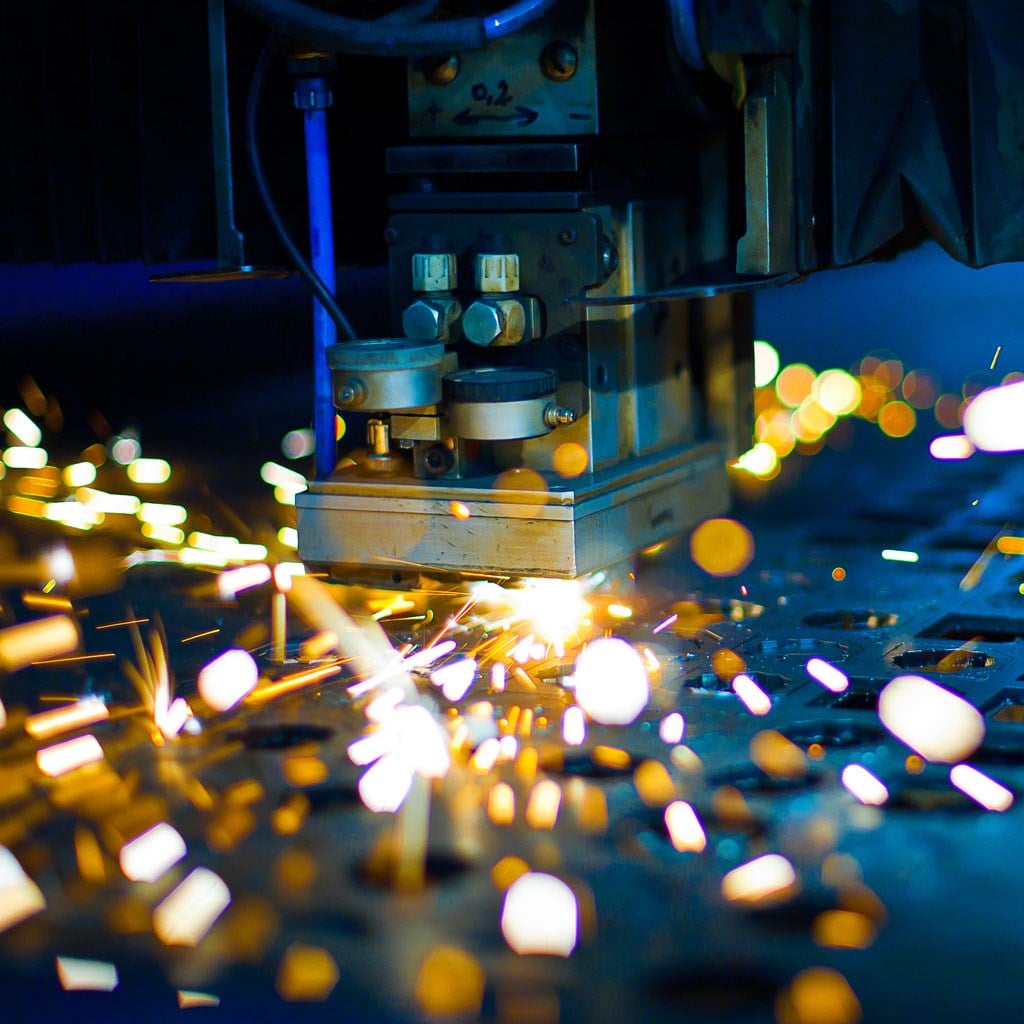

Image for WAHS Set to Celebrate Career & Technical Education Month

CTE is shaping the workforce of tomorrow, and WAHS is at the forefront. Throughout February, WAHS will highlight its CTE offerings that equip students with hands-on experience, industry-recognized certifications and real-world learning opportunities.

Image for WAHS Welding Lab to Undergo Significant Renovation, Expansion

WAHS is set to renovate and enlarge its welding lab, home to one of its 15 CTE programs, beginning this spring. The $3-million project will add 1,700 square feet to the facility, bringing the total footprint to 2,500 square feet, with 1,800 square feet dedicated specifically to welding.

Image for WAMS 2nd Marking Period Honor Roll Listing Released

WAMS released the year's second marking period honor roll listing. One-hundred and eighty-one students in grades seven and eight are named as having earned their status on the distinguished high honor roll, high honor roll or honor roll roster.

January 31, 2025

Image for WASD Bolsters Security With Advanced AI Detection System

A new layer of security is now in place at WASD with an advanced AI-based gun detection system now live to help protect students and staff from potential threats.

Image for Kindergarten Registration Week Scheduled for March 17-21

WASD's kindergarten and new student registration week is scheduled for March 17-21. Children must be age 5 on or before Sept. 1, 2025, in order to enroll.

Image for WAHS 2nd Marking Period Honor Roll Listing Released

WAHS released the year's second marking period honor roll listing. Three-hundred and forty-four students in grades nine through 12 are named as having earned their status on the distinguished honor roll, high honor roll or honor roll roster.

January 29, 2025

Image for CTE Programs Host 'Shop Breakfast' With Industry Employers

Every year just before Winter Break, programs within WAHS's Career & Technical Education Program — automotive, construction trades, engineering and robotics, precision machining and welding — host a "shop breakfast."

Image for 'Millionaire Magicians' Roster Released for Harlem Wizards Event

Twenty-four players have joined the team of teachers, students and staff who will take on the Harlem Wizards in a charity basketball event at 6:30 p.m. on Jan. 23 at WAHS.

Image for 25 Winners Selected in Annual WASD Holiday Essay Contest

WASD recently concluded its annual Holiday Essay Contest, during which students in kindergarten through third grade were asked to answer, in 200 words or less, “What is your favorite holiday memory and why?”

December 17, 2024

Image for Harlem Wizards to Return to the Magic Dome on Jan. 23

The Harlem Wizards are set to return to the Magic Dome at Williamsport Area High School in a fundraiser benefit game for the WASD Education Foundation on Thursday, Jan. 23.

Image for Former Superintendent Establishes Endowment to Support WASD's Music Programs

Former superintendent Dr. Oscar Knade has long believed that the strength of a school district’s music program provides the key to learning and builds not only a lifelong appreciation for the arts in students but also a positive district reputation within the community.

Image for 3 Student-Athletes Sign Letters of Intent

Three WAHS student-athletes committed themselves to their new homes today by signing their letters of intent.

November 13, 2024

Image for WAHS Girls Soccer Team Donates $1,715 to Kathryn Candor Lundy Breast Health Center

Our (top) hats off to the WAHS girls soccer team for raising $1,715 during its recent Pink Out game. Members of the team presented the funds to UPMC's Kathryn Candor Lundy Breast Health Center through the Susquehanna Health Foundation.

Image for WAMS 1st Marking Period Honor Roll Listing Released

WAMS released the year's first marking period honor roll listing. Two-hundred students in grades seven and eight are named as having earned their status on the distinguished high honor roll, high honor roll or honor roll roster.

November 6, 2024

Image for WAHS 1st Marking Period Honor Roll Listing Released

WAHS released the year's first marking period honor roll listing. Four hundred thirty-nine students in grades nine through 12 are named as having earned their status on the distinguished honor roll, high honor roll or honor roll roster.

November 5, 2024

Image for WAHS Marching Millionaires Win 2024 State Championship Title

The WAHS Marching Millionaires won the Cavalcade of Bands American Class Championships on Saturday, Nov. 2, at New Oxford High School.

Image for Curtin, Lycoming Valley Students Tour WAHS's CTE Program

The end of October marked the annual two-week-long tour schedule of WAHS Career and Technical Education (CTE) Program for fifth- and sixth-grade students.

Image for PAEA Names WASD a '2024 Outstanding Visual Arts Community'

WASD has been recognized as a 2024 Outstanding Visual Arts Community from the Pennsylvania Art Education Association (PAEA) for its commitment to visual arts education.

Image for WASD Education Foundation Holds 2nd Cherry + White Appreciation Night: A Night of Inspiration, Celebration

The WASD Education Foundation held its second Cherry + White Appreciation Night, an evening dedicated to honoring the invaluable contributions of WASD educators.

Image for WASD Education Foundation Announces $40,000 Founders Grant for Educational Excellence

To celebrate 20 years of fostering educational growth, the WASD Education Foundation announces the launch of the Founders Grant for Educational Excellence, a $40,000 grant opportunity open to WASD educators.

Image for WASD Education Foundation Awards $27,265 in Grant Funding to District Programs, Projects

The WASD Education Foundation approved over $27,000 in grant funding to support various district programs and projects in its first grant round for the 2024-2025 school year.

Image for Introducing the 2024-2025 School Board Student Representatives

Young leaders at WAHS are selected each year to serve as school board student representatives. This year’s student representatives are seniors Ella Adkins, Elijah Nilson and Chloe Pennings.

Image for 3 Selected to Receive 2024 Distinguished Alumni Awards

The WASD Education Foundation has named three Williamsport Area High School alumni who will receive its 2024 Distinguished Alumni awards.

Image for WASD Education Foundation Announces Keynote Speaker for 2nd Cherry + White Appreciation Night

The WASD Education Foundation is pleased to announce the keynote speaker for its second Cherry + White Appreciation Night, an evening dedicated to paying tribute to WASD educators.

Image for WASD Welcomes New Faculty, Administrators and Position Changes for 2024-2025 School Year

WASD announces its welcome to its new faculty members for the upcoming 2024-2025 academic year.

Image for 2024-2025 WASD Open House Schedule Announced

WASD has announced the dates for its annual round of open houses to kick off the start of the 2024-2025 school year.

Image for Find Locations of Free Summer Meals for Children, Teens

Nutritious free meals are available for children and teens 18 and younger at several locations throughout Williamsport during the summer while school is out of session. Click on the headline to find a link to a mapping tool to find a site near you.

Image for Nominations Sought for WAHS 2024 Distinguished Alumni Awards

The WASD Education Foundation is seeking nominations for the district’s 2024 Distinguished Alumni Awards. The 2024 recipients will be celebrated and recognized during its second annual Cherry + White Appreciation Night on Thursday, Sept. 19.

Image for New Head Boys' Soccer Coach Hired at WASD

WASD recently approved Brett Hofstrom as its new head boys’ soccer coach. Hoftsrom, a 1998 WAHS graduate, earned all-conference honors as a soccer standout for the team.

Image for WASD Approves Assistant Principal Shifts, Additions for 2024-2025 School Year

The Williamsport Area School Board recently approved several administrative changes that will take effect beginning July 1 for the 2024-2025 school term.

Image for 324 Receive Diplomas During 153rd Commencement Ceremony

Last evening, 324 graduates proudly celebrated their achievements and received their diplomas during WAHS's 153rd commencement ceremony.

Image for WASD Bids Farewell to 21 Retirees in Video Tribute

As WASD eyes the end of another school term, it pledged its farewell to 21 retirees. In a video tribute, administrators and supervisors said goodbye to this year's class of retirees, who, together, represent a combined 402 years of experience.

Image for 11 Students Celebrated for their Commitment to Military Service

WAHS recognized 11 seniors for their commitment to military service Monday afternoon. The Millionaire servicemen and -women were celebrated during a ceremony held in front of the Millionaire Military Wall.

Image for 128 Students Celebrated, 75 Inducted at WAHS National Honor Society Ceremony

One hundred and twenty-eight WAHS students were celebrated on Sunday afternoon during the National Honor Society Ceremony, and, from among them, 75 were inducted as new members from the junior and senior classes.

Image for 34 School-to-Work Students Recognized During Annual Appreciation Breakfast

Thirty-four students involved in WAHS's School-to-Work Program were honored during its annual Community Partners Appreciation Breakfast this morning at the high school.

Image for 2024 CTE Students of the Year Celebrated

The WAHS Career and Technical Education (CTE) Program hosted its second Student of the Year luncheon, during which the department's faculty selected their standout students to celebrate.

Image for Top Hat Dinner Honors WAHS Class of 2024's Top 5 Percent

The Class of 2024’s top 5 percent were recognized Wednesday night during the 11th annual Top Hat Dinner held at Le Jeune Chef on the campus of Pennsylvania College of Technology.

Image for 2024 WASD Spring Newsletter Now Available

Our 2024 spring newsletter is now available! Check out what's been happening and what's new!

Image for 2 WAHS Seniors Earn Scholastic Art Awards

Two WAHS students were recently earned Scholastic Art Awards, the nation’s longest-running and most prestigious art and writing recognition program for students in grades seven through 12.

April 22, 2024

Image for The GIANT Co. Donates $8,264 to WASD Food Service Program

The Giant Co. presented WASD with $8,264.35 recently to benefit the district’s food service program. The contribution was made with money raised through the company’s Feeding School Kids initiative.

Image for 6 WAHS Students to Perform in PMEA All-State Honors Music Ensemble

Six WAHS students have reached the highest level a high school musician can achieve by earning a place in the Pennsylvania Music Educators Association (PMEA) All-State Festival music ensembles.

Image for WASD Secures 'Best Communities for Music Education' Designation for 22nd Year

WASD has once again been recognized as one of the Best Communities for Music Education from The NAMM Foundation for its outstanding commitment to music education.

Image for WAMS 3rd Marking Period Honor Roll Listing Released

WAMS released the year's third marking period honor roll listing. Two-hundred and nine students in grades seven and eight are named as having earned their status on the distinguished high honor roll, high honor roll or honor roll roster.

Image for WHS Class of 1962 Establishes Scholarship Fund to Support Graduating Seniors

The WHS Class of 1962 recently established the Class of 1962 Scholarship Fund at the WASD Education Foundation, aimed at supporting the post-secondary pursuits of graduating students.

Image for WASD Education Foundation's 2024 Employee Giving Campaign Raises $8,944

With a matching contribution from Larson Design Group (LDG), the WASD Education Foundation was able to raise $8,944 through its fifth annual employee giving campaign this winter.

Image for State Education Secretary Tours WAHS's CTE Program

WAHS had the honor of hosting Pennsylvania Secretary of Education Dr. Kahlid Mumin, who explored the school's in-house Career and Technical Education (CTE) Program.

Image for 37 WAHS Students Attend Model UN, Earn Several Awards

Among the high school students who attended this year’s Model United Nations event at Bloomsburg University on March 20, 37 were from WAHS. Students collectively brought home a number of awards and recognitions

Image for 2 WASD Administrators Receive PASBO Awards

The Pennsylvania Association of School Business Officials (PASBO) selected Business Administrator Wanda Erb to receive a 2024 Gary Reeser Memorial Award, Pennsylvania’s top honor for school business officials. Additionally, Maintenance and Facilities Director Dale Crans received the 2024 David L. Nett Regional Chapter Leadership Award.

March 13, 2024

Image for WAHS SADD Club Wins 1st Place in Statewide Suicide Prevention Video Contest for 3rd Consecutive Year

WAHS SADD Club Wins 1st Place in Statewide Suicide Prevention Video Contest for 3rd Consecutive Year

A WAHS video produced to help raise awareness on mental health stigmas and suicide prevention received first place for the third consecutive year in a recent statewide PSA contest conducted by Prevent Suicide PA (PSPA).

Image for Hepburn-Lycoming Music Teacher to Receive PMEA Citation of Excellence Award

Hepburn-Lycoming Primary School music teacher Lori Nelson will receive the 2024 Pennsylvania Music Educators Association (PMEA) Citation of Excellence in Teaching Award for District 8 during PMEA’s All-State Festival next month in Erie.

Image for 3 WASD Odyssey of the Mind Teams Advance to State Level

Three of the five WASD Odyssey of the Mind teams that competed in the Regional Tournament on March 2 in Berwick are headed to the State Finals — all on first-place wins.

Image for Statement Regarding the Death of WASD Student

Last evening, the district received confirmation on the death of one of its students in an update from the Lycoming County Coroner’s Office. “We are deeply saddened to hear of the passing of one of our students,” said Superintendent Dr. Timothy S. Bowers. “Our hearts go out to the student’s family and friends during this very difficult time, and we extend our condolences to them.”

Image for 'Pippin' Coming to the WAHS Stage March 15-16

The WAHS music department is preparing for its annual musical production. “Pippin” is set to hit the stage beginning at 7 p.m., Friday, March 15, with a matinee performance scheduled for 1 p.m., Saturday, March 16.

February 28, 2024

Image for WASD Education Foundation to Participate in 2024 Raise the Region

The WASD Education Foundation (WASDEF) will once again participate in Raise the Region, the 30-hour online fundraising event hosted by the First Community Foundation Partnership of Pennsylvania on March 13-14.

Image for WAHS's Connor Poole Selected to Play in 2024 Big 33 Football Classic

WAHS senior Connor Poole has been selected to play in the Big 33 Football Classic as a kicker. Poole was named to the Pennsylvania roster earlier this winter to participate in the game against Maryland at 7 p.m. on Sunday, May 26.

Image for 'High School Musical Jr.' Coming to the WAMS Stage

The WAMS music department is preparing for its annual spring musical production. “High School Musical Jr.” is set to hit the stage beginning at 7 p.m., Friday, March 8, with a matinee performance scheduled for 2 p.m., Saturday, March 9.

February 15, 2024

Image for Grant Funding Helps Support Growth of Esports Program at WAMS

With a continued focus on preparing students for industries of the future, WAMS is building on an esports program where students can put their gaming skills to the test and compete against other esports teams from other schools across the state — all thanks to recent grant funding.

Image for WAHS Common Application for Scholarships Now Available

The WAHS Common Application for Scholarships is now available to members of the Class of 2024 pursuing post-secondary education. Applications and all supporting documentation must be submitted to the WAHS guidance office by Friday, March 22.

Image for WAHS Commercial and Advertising Art Students Partner With Gilson to Create Unique Snowboard Design

Fostering a connection between education and industry, WAHS Commercial and Advertising Art designed a custom snowboard in a recent collaboration with Gilson, a snowboard manufacturer based in Selinsgrove.

Image for Students Honor School Board Members as Part of National School Director Recognition Month

In recognition of Williamsport Area School Board members, students from across the district honored them for their service by presenting them with a brand-new book for installation in their respective school libraries.

Image for Larson Design Group Returns as Corporate Partner in WASDEF's 2024 Employee Giving Campaign

The WASD Education Foundation is pleased to announce Larson Design Group as the returning corporate partner for its 2024 Employee Giving Campaign. The campaign encourages district employees to consider enrolling in an ongoing payroll deduction program or making a one-time contribution to support the district’s nonprofit affiliate.

Image for WAHS Concludes Athletic Photo Restoration Project With WASD Education Foundation Grant Support

WAHS has successfully completed the restoration of its framed photos honoring state champion and First Team All-State players and teams displayed in the Commons of the building.

Image for WAHS Senior Receives Full Scholarship to College of the Holy Cross Through QuestBridge

WAHS senior Ian Sykes has been admitted to College of the Holy Cross and has been awarded a full, four-year QuestBridge National College Match Scholarship.

Image for WAHS Students Earn More Than 20 Awards at 2023 ConCon Event

WAHS students recently participated in the annual mock Constitutional Convention (ConCon) at Pennsylvania College of Technology, bringing home a number of awards and recognitions.

Image for 25 Winners Selected in WASD Holiday Essay Contest

WASD recently concluded its annual Holiday Essay Contest, during which students in kindergarten through fifth grade were asked to answer, in 200 words or less, “What does the holiday season mean to you and why?”

December 6, 2023

Image for WASD Awarded $46,179 in Grants to Support 16 Classroom, Program Enhancements

The Williamsport Area School District was recently awarded $46,179 in a combination of grants received from both the WASD Education Foundation and the First Community Foundation Partnership of Pennsylvania.

Image for WAHS 34th Annual Holiday Concert Set for Dec. 17

The WAHS music department will perform its annual Holiday Celebration at 3 p.m. on Sunday, Dec. 17, at the high school auditorium.

November 30, 2023

Image for Harlem Wizards to Return to the Magic Dome on Jan. 17; Tickets Now on Sale

The Harlem Wizards are set to return to the Magic Dome at WAHS in a fundraiser benefit game for the WASD Education Foundation on Jan. 17. The game, presented by Geisinger, will begin at 6:30 p.m., with doors set to open at 5:30.

Image for Curtin Intermediate Celebrates Socktober Milestone: More Than 50,000 Pairs of Socks Collected

Wrapping up its ninth annual Socktober last month, Curtin Intermediate School announced it has reached a milestone: more than 50,000 pairs of socks have been collected since the drive first began in 2014.

Image for WASD's 2023 Fall Newsletter Now Available

Our 2023 fall newsletter is now available! Check out what's been happening and what's new!

November 15, 2023

Image for 4 WAHS Senior Student-Athletes Sign Their Letters of Intent

Four WAHS student-athletes signed their letters of intent this afternoon to play their respective sports at the collegiate level next fall.

Image for 7 WAHS Students, 1 Faculty Member Among Those Honored at 'Women of Excellence' Celebration

Seven WAHS students and one faculty member were among those honored at the 15th annual Women of Excellence celebration, hosted by YWCA Northcentral PA on Thursday night at the Community Arts Center.

Image for Introducing the 2023-2024 School Board Student Representatives

Young leaders at WAHS are selected each year to serve as school board student representatives. This year’s student representatives are seniors Cyn-sere Coney, Faye Moore and Muireann Tran.

Image for PAEA Names WASD a '2023 Outstanding Visual Arts Community'

WASD has been recognized as a 2023 Outstanding Visual Arts Community from the Pennsylvania Art Education Association (PAEA) for its commitment to visual arts education.

Image for WASD Business Administrator Elected as Vice President of ASBO International Board

The Association of School Business Officials International (ASBO) recently announced that WASD Business Administrator Wanda Erb was elected as its Vice President for 2024 and slated to become President in 2025.

Image for WAHS Senior Wins Prestigious Rensselaer Medal Award

WAHS senior Sam Radulski has been selected to receive the Rensselaer Medal Award, a scholarship opportunity worth $160,000 for outstanding math and science students who choose to enroll at Rensselaer Polytechnic Institute.

Image for High Industries Makes $10,000 EITC Contribution to Support WAHS's Welding Program

High Industries Inc. recently made a $10,000 contribution in support of WAHS's welding program. The donation was made through the state’s Educational Improvement Tax Credit Program via the First Community Foundation Partnership of Pennsylvania.

Image for WAHS Celebrates 2023 Homecoming, Crowns This Year's King and Queen

WAHS celebrated Homecoming on Friday, Sep. 29. The Millionaires faced off against Central Mountain (a win, 47-13) and held its annual ceremony for those seniors on this year's Homecoming Court.

Image for WASD Education Foundation Holds 1st Cherry & White Appreciation Night: A Night of Inspiration, Celebration

The WASD Education Foundation held its first Cherry & White Appreciation Night, an evening dedicated to honoring the invaluable contributions of WASD educators and Distinguished Alumni.

Image for WAHS Senior Named Commended Student in 2024 National Merit Scholarship Program

WAHS senior Sam Radulski has been named a Commended Student in the 2024 National Merit Scholarship Program. A Letter of Commendation from the school and National Merit Scholarship Corporation was presented by Head Principal Dr. Justin Ross to this scholastically talented senior.

Image for 4 Selected to Receive 2023 Distinguished Alumni Awards

The WASD Education Foundation has named four WAHS alumni who will receive its 2023 Distinguished Alumni awards. The following individuals have been notified of their selection and have been invited to accept their award at WASDEF’s first Cherry and White Appreciation Night on Sept. 21

Image for WASD Education Foundation Announces Keynote Speaker for 1st Cherry + White Appreciation Night

The WASD Education Foundation is pleased to announce the keynote speaker for its first Cherry + White Appreciation Night, an evening dedicated to pay tribute to WASD educators. Michael Bonner will headline the Sept. 21 event, that also includes the induction of this year’s cohort of Distinguished Alumni.

Image for 'Showing Up Together': WASD Resurrects Campaign to Promote School Attendance

September is national Attendance Awareness Month, and the district has worked through the summer months to reorganize and reenergize its pre-pandemic “Be Present” campaign messaging under the new 2023-2024 slogan, “Showing Up Together.”

Image for WASD's New Teachers, Administrators and Position Changes for the 2023-2024 School Year

WASD announces its welcome to 40 of its new faculty members and administrators for the upcoming 2023-2024 academic year.

Image for WASD To Offer Season Passes for Home Athletic Events

In an effort to move to a cashless system, the WASD athletic department is now offering season passes for purchase to individuals and families.

Image for 2023-2024 WASD Open House Schedule Announced

WASD has announced the dates for its annual round of open houses to kick off the start of the 2023-2024 school year.

Image for Nominations Sought for WAHS 2023 Distinguished Alumni Awards

The WASD Education Foundation is seeking nominations for the district’s 2023 Distinguished Alumni Awards through July 14. The 2023 recipients will be celebrated and presented with their award during the return of the education foundation’s Donor & Alumni Appreciation Event on Thursday, Sept. 21.

Image for 298 Receive Diplomas During 152nd Commencement Ceremony

Last evening, 298 graduates proudly celebrated their achievements and received their diplomas during WAHS's 152nd commencement ceremony.

Image for WASD Bids Farewell to 23 Retirees in Tribute Video

As the WASD eyes the end of another school term, it pledged its farewell to 23 retirees. In a video tribute, administrators and supervisors said goodbye to this year's class of retirees, who, together, represent a combined 515 years of experience.

Image for Pennsylvania College of Technology Awards 14 WAHS Seniors with $2,000 Scholarships

Fourteen WAHS seniors planning to attend Pennsylvania College of Technology as a career and technical education student this fall were each presented with a $2,000 scholarship

Image for 14 Students Celebrated for their Commitment to Military Service

WAHS recognized 14 seniors for their commitment to military service. The Millionaire servicemen and -women were celebrated during a ceremony held in front of the Millionaire Military Wall, where their names will be emblazoned on a plaque to memorialize their enlistment.

Image for 49 WAHS School-to-Work Students Recognized at Annual Appreciation Breakfast

Forty-nine students involved in WAHS's School-to-Work Program were honored during its annual Community Partners Appreciation Breakfast this morning at the high school.

Image for 121 Students Celebrated, 75 Inducted at WAHS National Honor Society Ceremony

One hundred and twenty-one WAHS students were celebrated on Tuesday night during the National Honor Society Ceremony, and, from among them, 75 were inducted as new members from the junior and senior classes.

Image for 11 WAHS Student-Athletes Commit to College Athletics

Eleven WAHS student-athletes signed their letters of intent this afternoon to play their respective sports at the collegiate level next fall.

Image for WASD Education Foundation Presents $8,701 to Curtin Intermediate OM Team Headed to the World Finals

The WASD Education Foundation presented $8,701 to Curtin Intermediate School’s Odyssey of the Mind (OM) team, which heads to the World Finals at Michigan State University next week.

Image for WAHS Top Hat Dinner Honors Class of 2023's Top 5 Percent

The Class of 2023’s top 5 percent were recognized Wednesday night during the 10th annual Top Hat Dinner held at Le Jeune Chef on the campus of Pennsylvania College of Technology.

Image for 3 WASD Students Recognized During Law Day Celebration

Three WASD students were recognized for being among the 11 student winners in this year's Law Day Art & Essay Contest, hosted by the Lycoming Law Association at the Lycoming County Courthouse on Friday, May 12.

Image for Construction Trades Program Publicly Auctioning Off 13 Sheds

WAHS has items up for public bid through the online auction service Municibid.com. The items listed for sale are from the construction trades program and include 13 sheds and a chicken coop. The auction ends Friday, June 2.

Image for Harvard-bound WAHS Senior Named a 2023 National Merit Scholarship Winner

WAHS senior Ben Manetta has been named a 2023 National Merit Scholarship winner from a pool of more than 15,000 finalists nationwide.

Image for WAMS Boys Track and Field End Undefeated Season by Snagging Championship Title

The WAMS boys track and field team capped off an undefeated season by winning the 43-school Altoona Middle School Championship on Saturday, scoring 95.5 points

Image for WAHS Seniors to Be Featured in Downtown Billboard Series

Eight WAHS seniors will represent the Class of 2023 in a series of billboards each week beginning May 15 on the digital display along Market Street just off the Carl E. Stotz Little League Memorial Bridge.

Image for WASD Secures 'Best Communities for Music Education' Designation for 21st Year

WASD has once again been recognized as one of the Best Communities for Music Education from The NAMM Foundation for its outstanding commitment to music education.

Image for National Blue Ribbon School: Hepburn-Lycoming Primary Celebrates with Open House

Hepburn-Lycoming Primary School celebrated its designation as a 2022 National Blue Ribbon School with a night of music and art Thursday night.

Image for 'Over the Edge: Williamsport' Set to Return Sept. 9; Registration Now Open

River Valley Regional YMCA, YWCA Northcentral PA and the WASD Education Foundation are pleased to announce the return of Over the Edge this fall. The event will return for its sixth year to the William Hepburn Highrise, 400 Lycoming St., from 10 a.m. to 5 p.m. on Sept. 9.

Image for WAHS Senior Headed to National SkillsUSA Competition

Among the 14 WAHS students who competed in the 2023 SkillsUSA State Championships in Hershey last week, one is set to compete at the national level.

Image for 6 WAHS Student Musicians to Perform at PMEA All-State Festival

Six WAHS students will perform in the Pennsylvania Music Educators Association (PMEA) All-State Festival music ensembles April 19-22 at the Kalahari Resort in The Poconos.

Image for Curtin Intermediate OM Team Advances to 2023 World Finals

Curtin Intermediate School’s Odyssey of the Mind team is headed to the 2023 World Finals after securing a second-place win at the state round on Saturday at Lock Haven University.

Image for 34 WAHS Students Attend Model UN, Earn Several Awards

Among the 150 high school students from around the area who attended this year’s Model UN event at Bloomsburg University, 34 were from WAHS — collectively earning a number of awards and recognitions

Image for WASD's 2023 Spring Newsletter Now Available

Our 2023 spring newsletter is now available! Check out what's been happening and what's new!

March 27, 2023

Image for WAHS SADD Club Once Again Wins 1st Place in Statewide Suicide Prevention Video Contest

A WAHS video produced to help raise awareness on mental health stigmas and suicide prevention received first place for the second consecutive year in a recent statewide PSA contest.

Image for WAMS is Set to Present "Beauty and the Beast Jr."

WAMS is busy preparing for its opening night of this year’s musical, “Beauty and the Beast Jr.” The show is set to begin at 7 p.m., Friday, March 24, with a matinee performance scheduled for 2 p.m., Saturday, March 25.

Image for 'Little Shop of Horrors' Coming to the WAHS Stage

The WAHS music department is preparing for its annual musical production. “Little Shop of Horrors” is set to hit the stage beginning at 7 p.m., Friday, March 17, with a matinee performance scheduled for 1 p.m., Saturday, March 18.

Image for 3 WASD OM Teams Win 1st Place, Advance to State Finals

All three WASD Odyssey of the Mind teams that competed in the Regional Tournament on March 4 at Pennsylvania College of Technology are headed to the State Finals — all on first-place wins.

Image for 5 WAHS Singers Earn Spot on PMEA's All-State Choir

Six members of the WAHS choir performed during the PMEA Regional IV Choir Festival at the Community Arts Center this past weekend.

February 27, 2023

Image for Harlem Wizards Event Raises $20,164 for the WASD Education Foundation

After returning to WAHS for the first time since 2018, the Harlem Wizards event raised a net total of $20,164 for the WASD Education Foundation. The Feb. 9 event, presented by Geisinger, drew some 1,500 people to the Magic Dome.

Image for WASD Education Foundation to Participate in Raise the Region

The WASD Education Foundation is participating in Raise the Region, the 30-hour online fundraising event hosted by the First Community Foundation Partnership of Pennsylvania, from 6 p.m. March 8 until 11:59 p.m. March 9.

Image for WASD Music Department Holds 50th Annual All-District Choir Concert

The WASD's music department presented its 50th annual All-District Choir concert Monday night at the WAHS auditorium. The program featured the talent of about 300 student singers ranging from grades six through 12

Image for Harvard-bound WAHS Senior Named Finalist in 2023 National Merit Scholarship Program

WAHS senior Ben Manetta has been named a finalist in the 2023 National Merit Scholarship Program. Manetta is one of more than 15,000 finalists who will be considered for 7,250 National Merit Scholarships.

Image for 21 WAHS Students Earn Top 3 Placements in Regional SkillsUSA Competition

Twenty-nine WAHS students competed in the regional SkillsUSA competition at Pennsylvania College of Technology last week, and, of them, 21 earned top finishes.

Image for WASD All-District Choir Concert Scheduled for Feb. 13

The Williamsport Area School District’s music department will present its All-District Choir concert at 7 p.m. on Monday, Feb. 13, at the Williamsport Area High School auditorium.

Image for WASD Education Foundation Awards $7,325 to District Programs

The WASD Education Foundation announced its distribution of two grants totaling $7,325 that will provide support to and enhance district programs.

Image for 'Millionaire Magicians' Roster Released: 29 Join District Team to Take on the Harlem Wizards

Twenty-six players have joined the team of teachers, principals and staff who will take on the Harlem Wizards in a charity basketball event at 6:30 p.m. on Feb. 9 at WAHS.

Image for Students Honor School Board Members as Part of School Director Recognition Month

In recognition of Williamsport Area School Board members, students from across the district honored them for their service by presenting them with a brand-new book for installation in their respective school libraries.

Image for WAHS Performs Its 33rd Annual Holiday Concert

The Williamsport Area High School music department held its 33rd annual Holiday Concert this afternoon. The concert has become known as the department’s “gift to the community."

December 19, 2022

Image for Harlem Wizards to Return to 'The Magic Dome' on Feb. 9; Tickets Now on Sale

The Harlem Wizards are set to return to the Magic Dome at Williamsport Area High School in a fundraiser benefit game for the WASD Education Foundation on Thursday, Feb. 9, 2023.

Image for 25 Winners Selected in WASD Education Foundation Holiday Essay Contest

The WASD Education Foundation recently concluded its annual Holiday Essay Contest, during which students in kindergarten through third grade were asked to answer, in 200 words or less, “What are you most thankful for during the holiday season and why?”

Image for WAHS Students Earn More Than 20 Awards at ConCon Event

WAHS students participated in the annual mock Constitutional Convention (ConCon) at Pennsylvania College of Technology on Dec. 2, bringing home a number of awards and recognitions.

Image for Watch: Through the Eyes of a Millionaire

Our WAHS school board representatives, seniors Sydney Crews and Michael Harry, presented this video tonight to our school board. The two dreamed up the concept for the video, and worked to produce it with the help of our public relations department.

December 6, 2022

Image for WASD Awarded $74,290 in Grants to Support Projects, Program Enhancements

The Williamsport Area School District recently received a total of $74,290 in a combination of grants from both the WASD Education Foundation and the First Community Foundation Partnership of Pennsylvania.

Image for Millionaire Football Program to Join PHAC in 2024

More local rivalries, less travel time and schedule flexibility are just a few of the benefits the WASD football program is destined to have starting in its 2024 season.

November 23, 2022

Image for WAHS Marching Millionaires Win State Championship Title

The WAHS Marching Millionaires won the Cavalcade of Bands American Class Championships on Sunday, Nov. 13, at Hershey Park Stadium. The championship contest is the culminating event after 10 weeks of competition for the band.

November 16, 2022

Image for 4 WAHS Student-Athletes Sign Letters of Intent

Four WAHS student-athletes committed themselves to their new homes today by signing their letters of intent. Joined by their family, friends, coaches and teammates, the four made commitments to play their respective sport at the collegiate level next fall.

November 16, 2022

Image for WASD Education Foundation Announces Return of Holiday Essay Contest for K-3 Students

For the first time since 2019, the WASD Education Foundation, in partnership with the district’s Title 1 department, has brought back its annual Holiday Essay Contest.

Image for 5th-, 6th-Grade Students Receive Tours of WAHS CTE Program

Today marked the start of a two-week-long tour schedule of Williamsport Area High School's Career and Technical Education (CTE) Program for fifth- and sixth-grade students.

Image for WASD Students, Employee Among Those Honored at 'Women of Excellence' Celebration

Four WAHS students and one district employee were among those honored at the 14th annual Women of Excellence celebration, hosted by YWCA Northcentral PA.

Image for Public Feedback Requested on Potential Use of Public Schools by County for Polling Locations

The U.S. Department of Justice recently notified Lycoming County officials that many of its polling locations are not ADA compliant. As an alternative to bringing these locations into compliance, the county has requested use of public schools in selected locations to conduct voting services on election days — indefinitely — beginning in November 2023.

Image for WAHS Students Now Guaranteed Admission, Housing at Commonwealth University Campuses

WAHS students now have guaranteed admission to Commonwealth University of Pennsylvania, thanks to an agreement recently signed by the Williamsport Area School District.

Image for WAHS Celebrates Homecoming, Crowns This Year's King and Queen

WAHS celebrated Homecoming on Friday, Oct. 7. The Millionaires faced off against Wyoming Valley West (a win, 38-7) and held its annual ceremony for those seniors on this year's Homecoming Court.

Image for PAEA Names WASD a '2022 Outstanding Visual Arts Community'

WASD has been recognized as a 2022 Outstanding Visual Arts Community from the Pennsylvania Art Education Association for its commitment to visual arts education. This is the third time the district has received the designation.

Image for Curtin Intermediate Launches Annual #socktober Campaign for Area Agencies

Curtin Intermediate held its annual Socktoberfest on Sept. 30. The kickoff event launched the school’s month-long sock drive to benefit local agencies that provide family support in and around the Williamsport area.

Image for WASD Names New Head Girls Basketball Coach

The Williamsport Area School District hired Justin Marnon as its new head girls basketball coach. Marnon, who is a sixth-grade teacher at Lycoming Valley Intermediate School, replaces Terrill Seward who coached for the high school’s last four seasons.

September 20, 2022

Image for Hepburn-Lycoming Primary School Named a 2022 National Blue Ribbon School

Hepburn-Lycoming Primary School is a 2022 National Blue Ribbon School. The kindergarten to third-grade primary school, with an enrollment of about 405 students, is one of 297 schools to earn the recognition from the U.S. Department of Education.

Image for WAHS Senior Named National Merit Semifinalist

WAHS senior Ben Manetta has been named a Semifinalist in the 68th annual National Merit Scholarship Program. Manetta, one of about 16,000 Semifinalists selected nationwide.

September 14, 2022

Image for WAHS Senior Awarded With Academic Honor from College Board National Recognition Program

WAHS senior Miah Jones has earned an academic honor from the College Board National Recognition Programs. Recognized for her academic excellence and strong performance on College Board assessments, Jones was awarded the National African American Recognition Award.

Image for Introducing the 2022-2023 School Board Student Representatives

Young leaders at WAHS are selected each year to serve as school board student representatives. This year’s student representatives are seniors Sydney Crews and Michael Harry.

Image for Welcome Back to School!

From learning new schedules, classroom and morning routines (and — yes — even getting familiar with lunch for our little ones), to meeting new teachers and friends, our Millionaires kicked off the start of a new year today.

August 29, 2022

Image for WASD's New Teachers, Administrators and Position Changes for the 2022-2023

WASD welcomes 48 new faculty members and five new administrators for the upcoming 2022-2023 academic year.

Image for WASD to Conduct In-Person Hiring Events During School Open Houses

The Williamsport Area School District will host a series of hiring events for open school-based support positions across the district.

Image for WASD Students to Receive Free Breakfast, Lunch Through Community Eligibility Provision Program

By participating in the Community Eligibility Provision (CEP) Program, WASD will offer free breakfast and lunch to all students during the 2022-2023 school year.

Image for WAHS Teacher Set to Publish 2nd Book Through Amsterdam University Press

WAHS Spanish teacher Dr. Inti Yanes-Fernandez is set to publish his second book, “The Cid and King Arthur as Hegemonic Myths: Political Myth-Making and Intericonicity in the Christianization of the Iberian Peninsula and Britain,” through Amsterdam University Press.

Image for WAHS Teacher Named Outstanding Secondary Art Educator

WAHS art teacher Dr. Andrea McDonough has been selected as a 2022 Pennsylvania Art Education Association Outstanding Secondary Art Educator.

Image for Joint Statement from WASD and the Williamsport Area Board of Education on Recent Allegations

Click on the headline above to read a joint statement between WASD and the Board of Education.

Image for 321 Receive Diplomas at 151st Commencement Ceremony

WAHS's 2021-2022 academic year has just ended, and what a year it was. Tonight, 321 graduates proudly celebrated their achievements and received their diplomas during the high school’s 151st commencement ceremony.

Image for WASD Bids Farewell to 35 Retirees in Tribute Video

As the WASD eyes the end of another school term, it pledged its farewell to 35 retirees. In a video tribute, administrators and supervisors said goodbye to this year's class of retirees.

Image for 13 WAHS Seniors Commit to Military Service; New Millionaire Military Wall Dedicated

With grant funding from the WASD Education Foundation, WAHS was able to install its new Millionaire Military Wall, which will honor WAHS graduates heading into the military beginning with Class of 2022 and beyond.

Image for WASD Education Foundation Grants $4,000 to Support Summer Reading

With just days to go before summer vacation, the WASD Education Foundation announced its distribution of $4,000 to WASD’s elementary library system in support of the district’s revival of its #MillionairesRead Summer Reading Program.

Image for 113 Students Celebrated, 73 Inducted at WAHS National Honor Society Ceremony

One hundred and thirteen WAHS students were celebrated on May 26 during the National Honor Society Ceremony, and, from among them, 73 were inducted as new members from the junior and senior classes.

Image for Cochran Primary's OM Team Wins 10th Place at the World Finals

Cochran Primary School’s Odyssey of the Mind (OM) team won 10th place in the World Finals on Saturday at Iowa State University.

Image for 2022-2023 Fall Sports Registration Now Open; Deadline June 1

Middle and high school students wishing to play during the 2022-2023 fall sports season (football, soccer, cross country, girls tennis, girls volleyball, golf and cheerleading) will need to register on or by Wednesday, June 1.

Image for 42 WAHS School-to-Work Students Recognized at Annual Appreciation Breakfast

Forty-two students involved in WAHS's School-to-Work Program were honored during its annual Community Partners Appreciation Breakfast Wednesday morning at the high school.

Image for WAHS Top Hat Dinner Honors Class of 2022's Top 5 Percent

The Class of 2022’s top 5 percent were recognized Monday night during the ninth annual Top Hat Dinner held at the Genetti Hotel.

Image for 10 WAHS Student-Athletes Commit to College Athletics

Nine WAHS student-athletes signed their letters of intent this week to play their respective sports at the collegiate level next fall.

Image for WASD Education Foundation Grants $5,850 to Cochran Primary OM Team Headed to the World Finals

The WASD Education Foundation granted $5,850 to the Cochran Primary School’s Odyssey of the Mind (OM) team headed to the World Finals next week at Iowa State University.

Image for Stevens Primary School to Close June 30

The WASD School Board voted unanimously to close Stevens Primary, effective June 30, 2022. The closure comes after a thorough and careful review of option presented to the district and school board as part of the district-wide feasibility study.

Image for Construction Trades Students Restore Brandon Park Dugouts

Construction trades students from WAHS put in the work today at Brandon Park to begin restoring the dugouts at one of the baseball fields.

Image for WAHS Senior Headed to National SkillsUSA Competition

Among the 11 WAHS students who competed in the 2022 SkillsUSA State Championships in Hershey last month, one is set to compete at the national level.

Image for 4 WAHS Construction Trades Students Receive Awards

Four seniors in WAHS's construction trades program were recognized this morning by industry professionals for their work ethic and future commitment to the field.

Image for 3 WAHS Commercial Art Students Win Top 3 Spots in Regional Competition

Three WAHS commercial arts students landed in the top three places in the graphic design category in this year's regional PA Media & Design competition.

Image for WAHS Sophomore Among Winners Recognized at Law Day Celebration

WAHS sophomore Ella Wilson was recognized for being one of 10 student winners in this year's Law Day Art & Essay Contest, hosted by the Lycoming Law Association at the Lycoming County Courthouse on Friday.

Image for Notice: 2022-2023 Proposed Final Budget Available for Public Inspection

On May 3, 2022, the WASD School Board formally adopted the Proposed Final Budget of expenditures for 2022-2023. The budget is available for public inspection for 30 days during business hours at the District Service Center or can be viewed online.

Image for SADD Club Members Receive On-Field Recognition at PNC Park

Members of the WAHS SADD Club received on-field recognition Friday night for a recently produced video during a pre-game ceremony at PNC Park in Pittsburgh.

Image for 106 Students Celebrated, 59 Inducted at WAMS National Junior Honor Society Ceremony

One hundred and six WAMS students were celebrated Sunday during the National Junior Honor Society Ceremony, and, from among them, 59 were inducted as new members from grades seven and eight.

Image for WAMS Builders Club Donates $200 to JVB to 'Adopt' Summer Readers

The WAMS Builders Club had a busy morning today. After learning a little bit about leadership and the James V. Brown Library from its executive director, the group donated $200 to "adopt" 20 summer readers through its summer reading program.

Image for WAHS Model UN Students Win 3 Delegations at Bloomsburg University Competition

Congratulations to the 32 WAHS Model UN delegates who competed Thursday at Bloomsburg University of Pennsylvania. Although they didn’t walk away with the giant gavel this year, three delegations still won plaques.

Image for EQT Partners with WASD Education Foundation to Celebrate Teacher Appreciation Week

EQT is partnering with the WASD Education Foundation in a week-long effort to pay tribute to district teachers and raise funds to support classroom innovation during Teacher Appreciation Week from May 2-6.

Image for Over the Edge: Williamsport to Return This Fall With a Chance for Participants to 'Descend With the Sun'

River Valley Regional YMCA, YWCA Northcentral PA and the WASD Education Foundation are pleased to announce the return of Over the Edge (OTE) this fall — this time with some unique changes.

Image for WASD Secures 'Best Communities for Music Education' Designation for 20th Year

WASD has once again been recognized as one of the Best Communities for Music Education from The NAMM Foundation for its outstanding commitment to music education.

Image for 26 WAHS Students Attend Model UN, Earn Several Awards

Among the 130 area high school students who attended this year’s Model United Nations event at Pennsylvania College of Technology on April 8, 26 were from WAHS, representing 10 countries.

Image for WASD Schools Launch 'Find Your Anchor' Initiative

Last week, with the help of the district's team of counselors and social workers, schools across the district launched the Find Your Anchor initiative, a grassroots movement aimed at suicide prevention, awareness and education.

Image for WASD School Board Approves Administrative Position Changes for the 2022-2023 School Year

The Williamsport Area School Board approved a number of administrative changes tonight that will take effect next school year, beginning July 1.

Image for Cochran Primary OM Team Advances to 2022 World Finals

One WASD Odyssey of the Mind team will head to the 2022 World Finals next month after securing a first-place win at the state round Saturday at Lock Haven University.

Image for WASD Education Foundation's 2022 Employee Giving Campaign Raises $9,822

With a matching contribution from Larson Design Group, the WASD Education Foundation was able to raise $9,822 through its third employee giving campaign this winter. This year’s total marks a 40-percent increase over last year’s results.

Image for The GIANT Co. Donates $8,249 to WASD's Food Service Program

The Giant Co. presented WASD with $8,248.84 to benefit the district’s food service program. The contribution was made with money raised through the company’s Feeding School Kids initiative

Image for WASD Teacher to Receive Penn State School of Music's 2021-2022 Outstanding Music Education Alumni Award

WASD teacher Jennifer Wright has been selected to receive the Penn State School of Music 2021-2022 Outstanding Music Education Alumni Award.

Image for WAHS SADD Club Wins 1st Place in Statewide Suicide Prevention Video Contest

A WAHS video produced to help raise awareness on mental health stigmas and suicide prevention received first place in a recent statewide PSA contest conducted by Prevent Suicide PA.

Image for A Banner Season in Millionaire Wrestling Comes to an End

A banner wrestling season for the Millionaires came to an end during the Class AAA tournament at the GIANT Center in Hershey on Saturday, with three earning spots on the podium.

Image for 4 WASD OM Teams Advance to State Finals on April 2

Four of the five WASD Odyssey of the Mind teams that competed at the Regional Tournament on March 5 at Pennsylvania College of Technology are headed to the State Finals.

Image for WAHS Junior Accepted to Moore College of Art and Design's Summer Art and Design Institute

Avery Sauers’ life has been anything but ordinary. Never taking the adversities life has dealt her as an excuse, she has cleared her own path to her ultimate passion: digital art.

Image for 7 WAHS Students Selected to Perform in PMEA's All-State Ensembles

Seven WAHS students earned their seats through competitive auditions to perform with the 2022 PMEA All-State Ensembles. The slate of WAHS winners will play during this year’s All-State Conference and Festival from April 6-9 at Kalahari Resort and Conference Center in the Poconos.

Image for 'Into the Woods' Coming to the WAHS Stage

The WAHS music department is preparing to open its first musical production in two years. “Into the Woods” is set to hit the stage beginning at 7 p.m., Friday, March 18, with a matinee performance scheduled for 1 p.m., Saturday, March 19.

Image for WASD Names Dr. Richard Poole as Its New Assistant Superintendent

WASD hired Dr. Richard Poole as its new assistant superintendent Tuesday night. Poole, who is currently the district’s student services director, will take on his new post beginning July 1.

Image for Class of '85 Member Receives High School Diploma After 37 Years

It's taken nearly four decades, but Williamsport resident David Keene has finally received his high school diploma. Keene, a member of the Class of '85, left for Parris Island, S.C., as United States Marine Corps recruit just seven days before he was scheduled to graduate from WAHS.

Image for 11 WAHS Students Earn Top 3 Placements in Regional SkillsUSA Competition

Twenty WAHS students competed in the regional SkillsUSA competition at Pennsylvania College of Technology last week. Four seniors earned first-place finishes and now move on to the state competition in April.

Image for WASD Names New Varsity Head Coaches for Football, Girls Soccer

WASD hired two new head coaches for its athletic program Tuesday night. Michael Pearson and Beckham Sibiski will take over as head coaches for varsity football and varsity girls soccer, respectively.

Image for 3 WAHS Student-Athletes Commit to College Athletics

Joined by friends, teammates, family and coaches, three WAHS student-athletes signed to play their respective sport at the collegiate level in the fall.

February 2, 2022

Image for WASD Education Foundation Grants $4,708 to Support Program Enhancements

In its latest grant round, the WASDD Education Foundation recently awarded $4,708 to support three program enhancements across the district.

Image for Larson Design Group Returns as Corporate Partner in WASDEF's 2022 Employee Giving Campaign

The WASD Education Foundation is pleased to announce Larson Design Group (LDG) as its returning corporate partner in its 2022 employee giving campaign.

Image for WASD Education Foundation Releases 2020-2021 Annual Report

The WASD Education Foundation released its 2020-2021 Annual Report today, which highlights the organization’s key activities between July 1, 2020, and June 30, 2021.

Image for WAHS 32nd Annual Holiday Concert

The WAHS music department recently held its 32nd annual Holiday Concert. The concert, which has become known as the department’s “gift to the community,” brings together the combined talents of the high school’s band, choral and orchestra groups.

December 15, 2021

Image for WASD Education Foundation's Fall Grant Cycle Ends With $111,249 Granted to District Projects, Programs

The WASD Education Foundation recently brought its 2021-2022 fall grant cycle to a close. Over the course of the last several months, contributions made to district projects and programs have totaled $111,249.

Image for Marching Millionaires Place 4th Overall in Atlantic Coast Championships

The WAHS Marching Millionaires placed fourth overall at the Atlantic Coast Championships this past weekend at Central Dauphin High School in Harrisburg.

Image for Fall 2021 Parent-Teacher Conferences Online Scheduling

Parent teacher conferences will be held from 5-8 p.m. on Monday, Nov. 22, and from 8 a.m. to 8 p.m. on Tuesday, Nov. 23. All conferences will be by Zoom or phone.

Image for Purchase Tickets for Nov. 5 Millionaire Football Playoff Game

We're wishing our Millionaires good luck this Friday, Nov. 5, when they go up against the Altoona Mt. Lions in the first round of playoffs beginning at 7 p.m. at STA Stadium.

Image for 2021-22 Winter Sports Registration Now Open

The athletic department's online registration platform for athletic forms is ready for the 2021-22 school winter sports season. Student-athletes and parents may log back into their own accounts and re-use their current forms to register for sports for next school year.

October 18, 2021

Image for Jackson Students Read, Draw Along with Famed Author Alice Walker

Thanks to Crayola, students at Jackson Primary School received a first reading of Alice Walker's new children's book, "Sweet People Are Everywhere," straight from the author herself this afternoon.

Image for Subaru 'Adopts' 5 WAHS Classrooms to Help Support Supply Needs

Five teachers at WAHS have been able to knock off a few items on their wish list this fall, thanks to Subaru and its partnership with AdoptaClassroom.org.

Image for Statement Regarding Recent Misleading Reports on Myrtle Beach Incident

Following recent reports published this week, the Williamsport Area School District seeks to provide clarification on what has been publicly perceived as new developments in the Attorney General’s investigation of the 2018 Myrtle Beach, South Carolina, incident.

Image for WASD Names New Supervisor of Instructional Technology

WASD named Dustin Brouse as its new Supervisor of Instructional Technology. Brouse, an 11-year employee of the district, comes to the newly created position most recently from serving as the district’s Instructional Technology Specialist.

September 29, 2021

Image for WASD Education Foundation Opens 2021-2022 Grant Opportunities for Teachers

The WASD Education Foundation is accepting applications for its annual Teacher Mini-Grant Program and the first round of general grant funding for the 2021-2022 school year. Applications must be submitted to the foundation’s office on or by Friday, Oct. 22.

Image for Jackson Primary School Receives $6,500 Grant from Choose Kindness Foundation

Jackson Primary School was awarded a $6,500 grant from the Choose Kindness Foundation to begin a year-long, building-wide effort to promote and celebrate a welcoming, inclusive and caring school environment.

Image for Introducing New Roles, Faces of Leadership Across WASD for 2021-2022

WASD's new school year is just weeks away! The new year will bring with it many new faces and positions, especially for those serving in building or department leadership roles. Meet them here.

Image for WAHS Athletic Department Receives 2020-2021 District IV Sportsmanship Award

The WAHS athletic department was the recent recipient of the 2020-2021 District IV Sportsmanship Award from PIAA. The award is presented each year to a District IV high school based on overall program sportsmanship of student-athletes, coaches and spectators during the course of its most recent athletic seasons.

Image for WASD Education Foundation Welcomes 3 New Board Members

The Williamsport Area School District Education Foundation is pleased to announce this year’s recent appointment of three new members to its board of directors. Joining the board are Jon Mackey, Marwin Reeves and Loriann Rose.

Image for Over the Edge: Williamsport to Return This Fall

River Valley Regional YMCA, YWCA Northcentral PA and the WASD Education Foundation are pleased to announce the return of Over the Edge (OTE) this fall. The event is scheduled for Saturday, Sept. 25, 2021.

Image for Bidding Now Open for Curtin Intermediate School Renovations

WASD is currently accepting bids for renovations to Curtin Intermediate School. Bids must be received by the business office at 2780 West Fourth St. no later than 2 p.m. on Tuesday, July 27.

Image for WASD Bids Farewell to 30 Retirees in Tribute Video

As the WASD eyes the end of another school term, it pledged its farewell to 30 retirees. In a video tribute, administrators and supervisors said goodbye to this year's class of retirees, who, together, represent more than 740 years of experience.

Image for 297 Receive Diplomas at 150th Commencement Ceremony

WAHS's 2020-2021 academic year has just ended, and what a year it was. On Thursday night, 297 graduates proudly celebrated their achievements and received their diplomas.

Image for WAHS Choral Teacher Kent Weaver Honored by PMEA with '2021 Citation of Excellence'

The Pennsylvania Music Educators Association (PMEA) recently honored Williamsport Area High School teacher Kent Weaver with its 2021 Citation of Excellence for District 8. The citation was presented to Weaver by Head Principal Dr. Brandon Pardoe during the high school’s annual “Poptastik!” concert on June 2.

Image for 91 Students Celebrated, 48 Inducted at WAHS National Honor Society Ceremony

Ninety-one WAHS students were celebrated Monday night during the National Honor Society Ceremony, and, from among them, 48 were inducted as new members from the junior and senior classes.

Image for 78 WAMS Students Inducted into National Junior Honor Society

Seventy-nine WAMS students were inducted into the National Junior Honor Society on Thursday morning. The ceremony, held in the middle school auditorium, honored each of the inductees who represent what are known as The Four Pillars — or backbone — of NJHS: scholarship, service, leadership and character.

Image for WASD Education Foundation Grants $6,000 to 2 OM Teams Headed to the World Finals

The WASD Education Foundation granted $6,000 to the district’s Odyssey of the Mind teams headed to the World Finals next week in Orlando, Fla. The foundation was able to contribute a combination of gifts received from those in the community, area businesses and WASDEF’s unrestricted fund.

Image for 19 WAHS Student-Athletes Commit to College Athletics

Joined by friends, teammates, family and coaches, 19 WAHS students signed to play their respective sport at the collegiate level in the fall.

Image for WAHS Senior Wins State Award for Construction Trades

WAHS senior Tommy Harper won the Pennsylvania Foundation for Housing and Endorsed Trade Program Student Recognition Award. Harper, a Construction Trades student, was selected because of his "dedication and hard work displayed in learning the trade."

Image for The Giant Co. Donates $21,486 to WASD's Food Service Program

The Giant Co. presented WASD with $21,486.75 this morning to benefit its food service program. The contribution was made through the company's Feeding School Kids initiative, an effort focused on supporting food programs at local public schools.

Image for WAHS Top Hat Dinner Honors Class of 2021's Top 5 Percent

The Class of 2021’s top 5 percent were recognized tonight during the eighth annual Top Hat Dinner held at the Genetti Hotel. Seventeen seniors were celebrated for their academic excellence, as well as their selected faculty honorees who influenced and inspired that success.

Image for 36 WAHS School-to-Work Students Recognized at Annual Appreciation Breakfast